Minimising Security Risks while implementing AI in Financial Institutions

As the financial institutions are continuing to develop at a rapid pace to compete with growing trends and technologies in this digital space, the adoption of artificial intelligence (AI) has become increasingly widespread. Financial sectors are leveraging AI-driven technologies to strengthen their resilience against a diverse range of threats, from cyberattacks to financial fraud. It’s time for us to relook into how AI enhances the capabilities of financial organisations and the evolving risks in AI space to mitigate before it erupts.

However, introducing AI-based security controls also brings new risks and challenges which needs more robust security capabilities to identify the pros and cons while implementing AI in the financial institutions. However, Artificial Intelligence (AI) systems are rapidly transforming industries, society, and everyday life. Before diving into the benefits of using AI in the current threat landscape, it is crucial to understand the associated risks to ensure responsible and safe implementation.

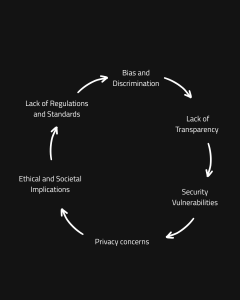

Some of the key AI risks while implementing the AI use cases across the Organization are –

AI systems offer immense potential, but understanding and addressing their risks is essential for maximising benefits and minimising destruction. However, ongoing research, transparent policies, and cross-sector collaboration are key to ensuring that AI systems are safe, fair, and beneficial for all.

AI-enabled security controls leverage machine learning, deep learning, and advanced analytics to monitor, detect, and respond to threats in real time. Applications include automated transaction monitoring, biometric authentication, behavioural analytics, and intelligent intrusion detection systems. While these technologies offer significant advantages, they also introduce unique vulnerabilities, such as adversarial attacks, data poisoning, and model exploitation.

Challenges in AI Adoption

While AI offers transformative potential, its adoption is not without significant challenges. Overcoming barriers related to data, talent, cost, ethics, culture, integration, security, and ROI is essential for organisations seeking to harness the full power of AI. Some of the key challenges evolving are –

- Adversarial Attacks: Malicious actors may attempt to deceive AI models by feeding them manipulated data, leading to incorrect decisions or bypassing security controls.

- Data Privacy and Integrity: AI systems require large volumes of sensitive data, increasing the risk of data breaches, unauthorised access, and data manipulation.

- Data Quality and Availability: Without reliable and accessible datasets, AI models cannot be trained effectively, leading to optimum outcomes and unreliable predictions.

- Model Bias and Fairness: AI models can inadvertently spread or amplify biases present in training data, leading to unfair or discriminatory outcomes.

- High Implementation Costs: Developing and deploying AI solutions often requires significant investment in technology, infrastructure, and personnel. Need to be considered ongoing maintenance and updates add to the long-term financial burden to manage AI adoption.

- Change Management and Organisational Culture: Conflict to change, lack of understanding, and fear of job displacement can create barriers among staff. Strong leadership and clear communication are essential to foster acceptance and encourage collaboration.

- Integration with Legacy Systems: Many organisations operate with legacy IT systems that are not designed to support modern AI technologies. Integrating new AI solutions with existing infrastructure can be complex, risky, and expensive to make sudden changes.

- Security Risks: AI systems can introduce new vulnerabilities, such as exposure to adversarial attacks, data breaches, or unintended consequences arising from autonomous decision-making. Ensuring robust cybersecurity measures are in place is critical to mitigating these risks.

- Regulatory Non-compliance: Failure to adhere to evolving legal and regulatory frameworks can result in significant penalties and reputational damage.

- Skills and Talent Shortage: There is an open risk on the shortage of AI resources with skills competency. The competition for talent is fierce, making it difficult for organisations to build and retain effective AI teams.

Strategies to Reduce Security Risks

In the emerging digital transformation place, organisations and individuals face a growing array of security threats. Implementing effective strategies to reduce security risks is essential in safeguarding sensitive information, maintaining operational integrity, and protecting reputations. Some of the key strategies to mitigate security risks across a variety of contexts, including digital, physical, and personnel factors are –

1. Robust Data Governance

Establish strict data governance policies to ensure that data used for training and operating AI models is accurate, up-to-date, and securely managed.

2. Model Transparency and Explainability

Adopt AI models that offer explainability, allowing stakeholders to understand how decisions are made. Transparent models facilitate better oversight, enable the detection of biases, and support compliance with regulatory requirements such as the General Data Protection Regulation (GDPR).

- Implement Robust Access Controls

Limiting access to sensitive information and systems is a fundamental security strategy. Use strong authentication methods such as multi-factor authentication (MFA), unique user IDs, and regularly reviewed permissions.

- Employ Strong Data Encryption

Encrypt sensitive data both at rest and in transit. Use industry-standard encryption protocols to protect information from unauthorised access, especially when transmitting data over public or unsecured networks.

- Monitor and Audit Systems Continuously

Implement continuous monitoring solutions to detect unusual or unauthorised activity within networks and systems. Regularly audit logs and review security incidents to identify potential vulnerabilities and improve response strategies.

- Backup Data Regularly

Establish regular, automated backups of critical data and systems. Store backups in secure, off-site locations and periodically test restoration procedures. This helps mitigate the impact of ransomware attacks, hardware failures, or accidental data loss.

- Assess and Manage Third-Party Risks

Vendors and service providers can introduce security vulnerabilities. Conduct due diligence when selecting partners, require adherence to your security standards & regularly review their security practices.

- Prepare and Test Incident Response Plans

Develop detailed incident response plans that outline steps to take in the event of a security breach. Conduct regular drills and tabletop exercises to ensure readiness and to identify areas for improvement

9. Foster a Culture of Security Awareness

Provide regular training for staff on AI risks, secure data handling practices, and incident response procedures. Encourage a culture of vigilance and continuous improvement to adapt to the evolving security landscape.

10. Stay Informed About Regulatory Changes

Keep abreast of regulatory developments related to AI and cybersecurity in the financial sector. Work closely with legal and compliance teams to ensure that AI deployments meet all applicable standards and reporting obligations.

The integration of AI-enabled security controls offers financial institutions powerful tools to stop emerging threats and protect valuable assets. However, reducing security risks requires a multi-faceted approach, combining technical, procedural, and human-centred strategies. By implementing these measures, organisations can significantly enhance their security posture and minimise potential threats. reaping the benefits of AI-driven innovation.

Article was written by: Kavitha Srinivasulu

Kavitha is an experienced Cybersecurity and Data Privacy Leader with overall 22 years of experience focused on Risk Advisory, Data Protection and Business Resilience. She demonstrates expertise in identifying and mitigating risks across ISO, NIST, SOC, CRS, GRC, RegTech and in emerging technologies with diverse experience across corporate and Strategic Partners. She possesses a solid balance of domain knowledge and smart business acumen, ensuring business requirements and organisational goals are met.