Making changes and adopting new technologies have become the new normal. The world is transforming from the old traditional infrastructures to becoming more cloud-based, and focusing on data protection in this digital era is explicit. Cloud adoption has emerged in various industries as connecting from anywhere became a need of the hour during COVID-19. Based on the availability, scalability, and flexibility of cloud computing, most organisations have shifted from old legacy models to cloud adoption to work in an uninterrupted environment with full access.

Adopting to cloud in the Insurance sector has become a big game changer as it has revolutionised the insurance market by providing various benefits, including streamlined operations, improved efficiency and access to real-time data for better decision making. The amount of data managed and there are many sources of risks and challenges prevailing in the current threat landscape while adopting to cloud; however, every organisation needs a very affordable, scalable, flexible, and fast methodology to speed up the services for their consumers.

Cloud security helps the cloud computing model with various kinds of security controls, such as data availability, data storage, computing resources, servers, applications, network capabilities, developing tools, open access, flexibility, etc. These controls are built and managed by engaging with Cloud Service Providers (CSPs) using a shared responsibility model to increase resilience and data protection.

Some of the key use cases that can help the Insurance industry in increasing resilience and business growth are as follows –

Cloud-based Use Cases:

- Underwriting – Cloud adoption in the insurance sector helps the underwriters to make better decisions by increasing the accuracy, efficiency and availability of data without challenges.

- Claims Management – Insurance companies can streamline and optimize the claims process by centralizing the data using cloud and decrease the response time of claims requests more effectively.

- Marketing Campaigns – Can scale the marketing efforts efficiently, modifying campaign approaches, launching new products, designing and creating best user specific experience.

- Customer User Experience –Insurance companies can increase customer satisfaction by using the cloud capabilities to make it more interactive and reduce the retention rates. It also helps in driving business growth by responding to customer requirements in a timely manner and providing personalised solutions.

Organisations are moving more and more of their data and applications to the cloud day by day. A recent report forecasted that, by 2025, 80% of enterprise workloads will be in the cloud. Emerging cloud computing technologies have created numerous risks and challenges while building innovative technology for business growth.

Cloud Adoption Challenges:

Cloud security challenges are rising day by day due to the enormous volume of data stored, managed, and processed through a network of shared services, reducing the cost of IT infrastructure. When it comes to implementing a cloud-based solution, many organisations are concerned about data security, data loss and cyberattacks.

Organisations are changing to cloud adoption in larger numbers than ever in the recent past. Gartner reported that 85% of organisations will be “cloud-first” by 2025. To overcome the pressure to work remotely, to uplift the scalability, expand the availability, reduce overhead costs, and to keep up with the growing competition, cloud adoption is becoming central to almost any growth strategy in the Insurance sector significantly.

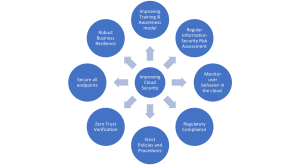

Some security measures can protect data in cloud computing and support future cloud migration. Some of the key measures to improve are:

Cloud adoption is reforming the insurance sector by reducing costs over the past decade, with cost-effective and highly scalable business benefits. Cloud adoption is secured by enabling security controls to make the most of digital transformation and ease the customer experience to achieve operational efficiency.

Some of the key benefits of enabling security controls during cloud computing are –

Cloud computing is crucial in today’s threat environment, and its adoption has been the driver of digital transformation in the insurance industry. Its propositions is primarily on higher data management flexibility compared to traditional systems, Data security against data breaches and protecting the customer data from cyber thefts. Insurers can seamlessly transform their legacy systems by deploying cloud-based systems to satisfy emerging customer needs constantly.

Forward-thinking organisations are rapidly embracing cloud technology while budgeting for expenses on bandwidth, migration, training, and rewriting application architecture.

Most on-premises systems require downtime and lots of complex software upgrades and patches that take a lot of time and manpower. These typically must be done in regular intervals to avoid any security risks. Cloud-based systems play a key role in automatically backing up and replicating the data without requiring any intervention from the business, and ensuring the customer data is secured in the Insurance domain.

Cloud computing network is a fast-growing network-based technology without leaving exceptions for vulnerabilities or risks in any operating model. It’s essential for building a cloud computing model with appropriate data security controls to ensure a secure environment and business resilience in the digital space.

This article was contributed by Kavitha Srinivasulu, a valued external guest writer.